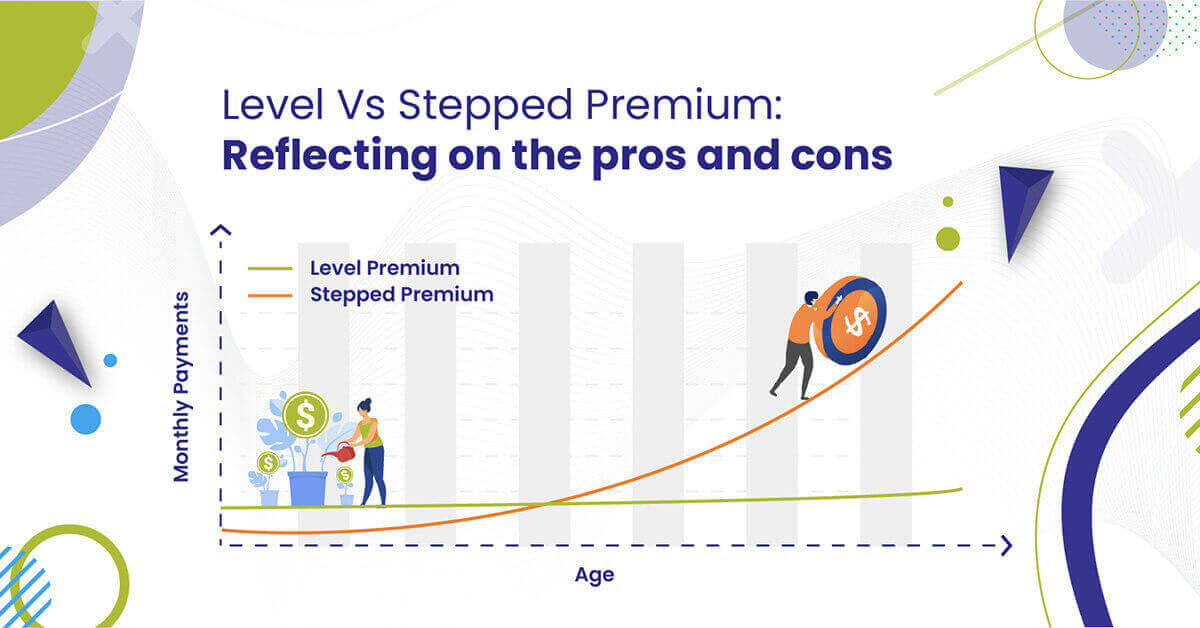

A CLOSE STUDY ON THE LEVEL AND STEPPED PREMIUM. REFLECTING ON PROS AND CONS

Life is full of uncertainties that can hardly be deferred however one of the preventive measures is insurance cover. When buying insurance, you need to pay a premium generally categorised into the level and stepped.

Before choosing any out of the two premiums, remember, the life insurance premiums depend on several factors like age, health history, occupation, family health history, policy term, hobbies etc. An individual should weigh the pros and cons of these two types of premiums before reaching a consensus.

This blog will undertake a brief comparison between level and stepped premium; however, you should talk to your insurance adviser to make an informed decision.

Defining Level Premium

Level premium can be defined as a type of premium that is not affected by age, and a beneficiary has to pay a fixed premium for a certain term. Initially, you need to pay a high premium; however, it might not seem burdensome on your budget with time.

Why choose level premium?

- It’s usually cheaper for the long-term.

- Better Option for a long-term security

During the insurance term, level premiums remain static, which indicates that you will pay the same amount with an increase in your age. Another important thing is that the initial premium is relatively high if an individual is looking for an insurance policy for a longer period.

When choosing a level premium, people should check the cover amount and age of the policy to avoid any inconveniences. Furthermore, level premiums can be affordable to older folks as you can gather more savings with age. For any further details or queries, you should consult an insurance adviser.

Pitfalls Of Level Premium

- Expensive in the beginning

- Premiums can still increase slightly due to inflation rate, Consumer Price Index (CPI) and increase in policy fees.

Besides offering benefits, the level premium also has some pitfalls that you need to know before making an informed decision. As level premiums require you to pay a high amount during the initial period, it might be difficult for some people to afford.

Defining Stepped Premium

If you are searching for a life insurance policy that is cost-effective initially, then stepped premium can be a good option. See, stepped premium increases with age; however, it’s pretty cheap at the beginning of the policy term.

After completing one year of the policy, the insurer recalculates the policy amount you are paying. The premium keeps on rising each year because the chances of making claims are higher. Well, exceptions exist as policies are subjected to certain factors that you need to confirm from an insurance adviser.

Why Choose Stepped Premium?

- A budget-friendly option initially

- Aligns with the pursuit of a young family

Stepped premium is often considered a budget-friendly option for those who can’t afford to pay a higher premium in the initial phases of the term. However, this premium will suit a young individual until he/she has paid off other past debts like student loans.

Demerits Of Stepped Premium

- Premiums increases with age

- Difficult to pay in the long run

A significant issue that you have to face if you select stepped premium is that the premium amount will keep rising as you grow older. Most people find it difficult to continue with a stepped premium as the policy term verges towards the end.

In case you have cues of past debt to pay then it might be difficult for you to afford the rising stepped premiums.

Final Thoughts

See, paying stepped premiums for a longer period won’t prove suitable for your budget; that’s why people shift from stepped to level premium. Hence choose an insurance company that enables you to shift from stepped to level without much hassle. To make an informed decision, you should consult an insurance adviser who will offer expert advice and help you choose a premium that suits your financial situation.

0 Comments