Interesting movements have been recorded among the NZ Bond market and domestic data points since May RBNZ’s policy meeting. Yields have peaked in NZ and customer sentiment plummeted to the lowest level on record and Business confidence drifted to the key level.

Amidst its hawkish tone, the Reserve bank of New Zealand needs to pay attention to what’s happening in the NZ govt bond market and the other data points too.

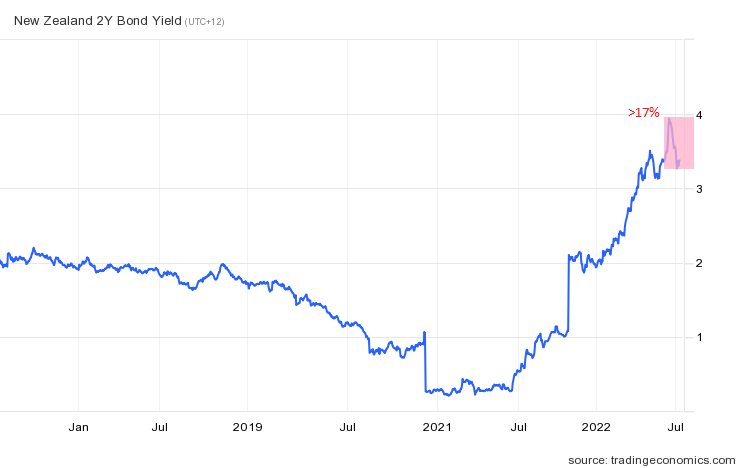

Yields: Reverse Thrust.

Apparently, last week the two-year mortgage rates posted their largest drop since 2020 and the average two-year mortgage rate plunged from 5.80% to 5.35%. Behind the curtains, the New Zealand 2-year bond yield dropped more than 17%, the highest fall since March 2021, whilst, the 10-year yields also drifted by more than 17%. In the US, yields on the 10-year benchmark treasury note fell more than 21% as investors are taking hide in safe assets like Treasuries. Do these moves suggest lower mortgage rates in the coming weeks?

Figure 1: Reverse Thrust

A year ago, the average two-year rate was 3.50% a hike of 52%. Therefore, on an average home loan of $750,000 @3.50% rate, the monthly mortgage repayment is $3365 per month. However, with a 5.35% rate household needs to pay $4188 which means $820 extra to be paid per month (a staggering 24%hike). Thus, higher mortgage repayments alongside the higher fuel costs are squeezing the household budgets.

Data points: Hope in short supply.

Data points (GDP, Consumer Confidence, and Business Outlook) were flown below safe altitude post-RBNZ’s meeting in May.

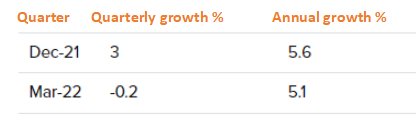

- NZ economic activity fell 0.2 percent in the March 2022 quarter, following a rise of 3.0 percent in the December 2021 quarter (Data derived from Stats NZ).

Figure 2: NZ economic activity (Data derived from NZ stats)

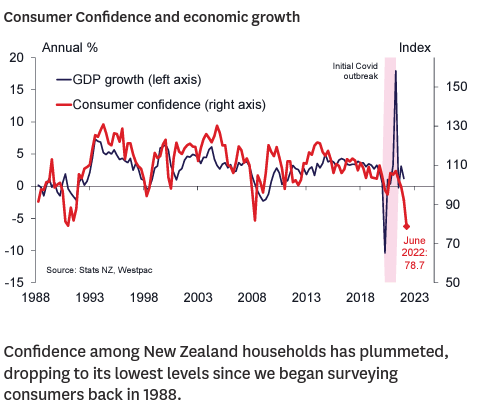

- Westpac McDermott Miller Consumer Confidence Index plummets to the lowest level on record. “Confidence among New Zealand households has plummeted, dropping to its lowest levels since we began surveying consumers back in 1988” as per the report dated 21 June 2022.

Figure 3: Consumer confidence Index Westpac

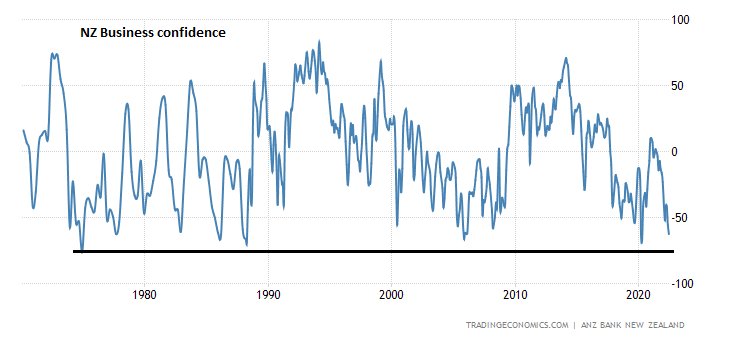

- The June update of the ANZ business outlook survey stated “Business confidence fell 7 points to -63% in June”. This was the 12th straight negative reading, sitting at the lowest level since April 2020.

Figure 4: NZ Business confidence

Despite the height of the weaker data points, RBNZ has delivered another 50bps hike on 13th July to tame inflation which is soaring at 7.3%. Beyond July’s RBNZ meeting the market is pricing an additional 50bps hike in August as well to push the OCR to 3%, which is not evident since July 2015. Demand-pull inflation is the key driver to expect another 50ps hike in August.

Furthermore, we also expect that OCR will peak around 3.90 % by the end of 2022-1Q 2023.

DISCLAIMER: The opinions expressed in this article are the author’s and shouldn’t be taken as financial advice, or a recommendation of any financial product.

We hope the interest will be go down soon be we struggle everything goes up.

Thanks

A lot of people want to buy a house but they can’t afford of high interest and can’t afford the deposit